The obligation to generate electronic invoices and the fulfilment of certain requirements in the issuance of the same is born under the Law of the Crea y Crece, Law 18/2022, of the Ministry of Economy with the aim of controlling delinquency, and on the other hand by the regulation of the Anti-Fraud Law, Law 11/2021 of the Ministry of Finance to pursue tax fraud, and all this within a European context, Directive 2006/112/EC developed in the digital era, which refers to the VAT rules, aimed at combating VAT fraud in the Community. In short, VERI*FACTU’s vocation is no other than to prevent fraudulent and evasive practices.

The electronic invoice is based on article 29.2j) of the General Spanish Tax Law, which states the following:

‘The obligation, on the part of producers, marketers and users, that the computer or electronic systems and programs that support the accounting, invoicing or management processes of those who carry out economic activities, guarantee the integrity, conservation, accessibility, legibility, traceability and inalterability of the records, without interpolations, omissions or alterations that are not noted in the systems themselves. Regulations may establish technical specifications to be met by these systems and programs, as well as the obligation for them to be duly certified and to use standard formats according to the legality.

All individual entrepreneurs, professionals, individuals or legal entities subject to personal income tax on income from economic activities, corporation income tax or non-resident income tax are obliged to issue electronic invoices, with the exception of those wo are registered with the Immediate Supply of Information (SII).

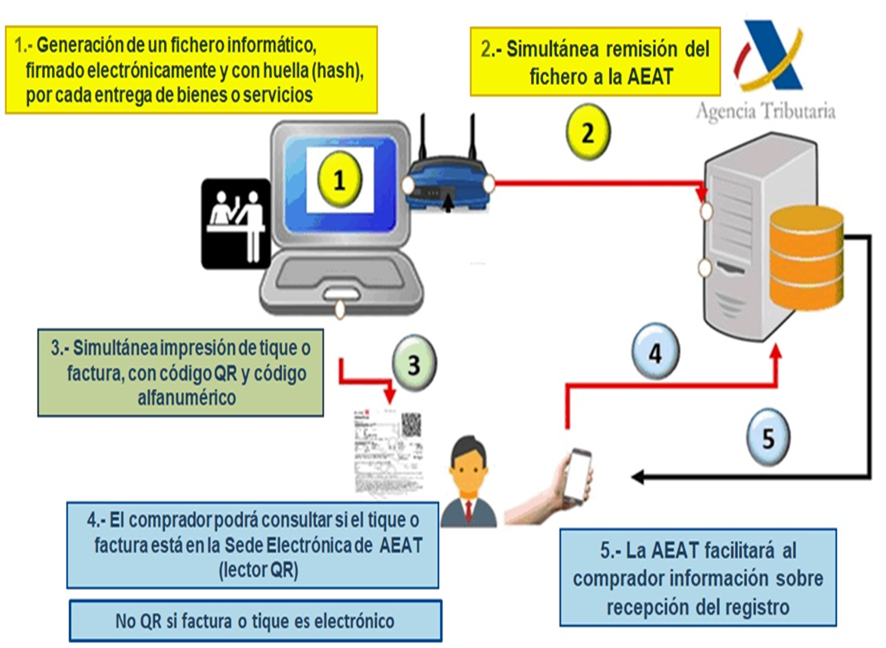

Those obliged to issue electronic invoices will have to send the invoice in XML format immediately to the State Tax Agency and, in turn, the tax administration will have to do three things:

1. Assign a unique identifier to that invoice.

2. Assign a QR code

3. And a text identifying that the invoice is compatible with the VERI*FACTU system and that it has been validated by the public administration.

With these three requirements, the invoice will be returned to the company in PDF format, and the company will be able to send it to the customer.

The adoption of this VERI*FACTU regulation comes into force before 1 July 2026. In relation to certain computer or electronic systems and programs that do not comply with the requirements will lead to penalties regulated in article 201 of Law 58/2023 of 17 December, General Tax Law, penalties ranging from 1,000 to 150,000 euros and can be imposed both on the manufacture and commercialization of computer systems and on the user